App Config

Adjust Guerrilla's settings to enhance your trading

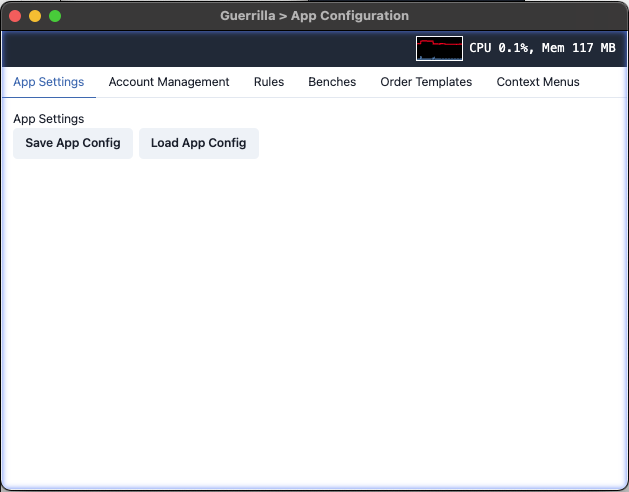

App Configuration can be accessed by clicking File > App Config

This opens a window with multiple tabs for configuring different parts of the application. The first tab titled “App Settings” enables you to save and load app configuration files.

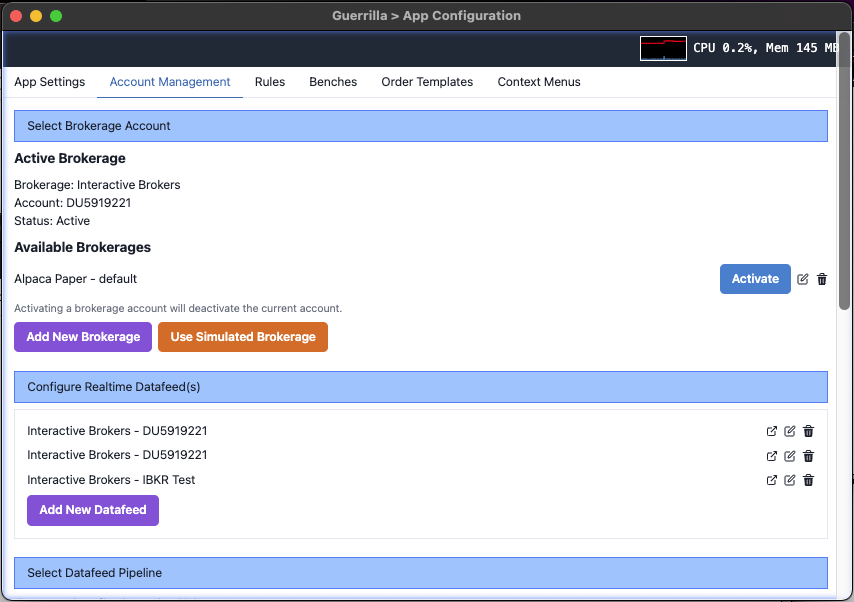

Account Management

The “Account Management” tab is where you configure brokerage and datafeed connections.

Click “Add New Brokerage” and follow on-screen instructions for any of the support brokerages. A list of all available brokerages is displayed but only one can be active at any time. Activating another brokerage account deactivates all other brokerage accounts in the system. This is important to keep in mind in case you have tactics configured to execute on a brokerage that supports specific asset types (such as Options) and you switch to a brokerage account that does not support that asset type.

Click “Add New Datafeed” to configure a realtime datafeed. Guerrilla also allows you to combine datafeeds. In the event that you like IBKR equities data the most, you can pay a subscription fee (~4 USD per month) for that data and use it in combination with free options data from Tradier. See the Multi Datafeed section to see how to implement this.

If you are only trading paper accounts, you are welcome to use the simulated datafeed or test datafeeds that ship with the application by selecting the appropriate radio buttons at the bottom of the Account Management screen

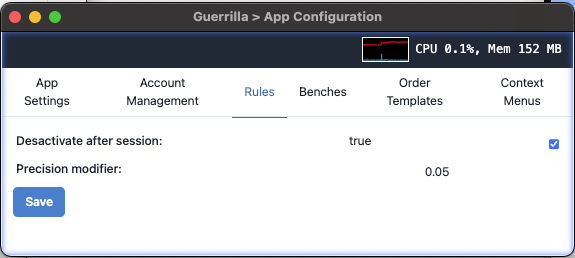

Tactics (Rules/Plays)

There are two options here:

-

Deactivate after session - instructs the system to deactivate all active rules at the end of the trading day. This prevents the unintended execution of a rule that was created from a previous period and is no longer optimal due to changing market conditions. Mark this config as false if you do not want this feature.

-

Precision Modifier - has an impact on the execution of price-based tactics. Consider the following rule: “Long 200 shares of AAPL when price touches VWAP”. There are certain instances where price goes near VWAP, but does not exactly touch the VWAP before reversing in a favorable direction. If the precision modifier was set at 0.10, it allows the rule to execute when price is within the range of [VWAP + 0.10] and [VWAP - 0.10]

Click on “Save” to commit your settings to memory.

Benches

The only setting here enables/disables the creation of position groups when benches are created. See here for more information about Position Groups

Order Templates

See here for the configuration of Dynamic Quantity Mapping

Context Menus

See here for the configuration of Context Menus